Series Overview

I asked a group of students recently what they thought was a reasonable hourly rate to ask a client. They came up with rates in the range of €20-30 an hour. Now, spoiler alert, this is really low.

In getting to this number, they made a few classic mistakes. Since a business sells products that have a price, it's a quite foundational part of running your business. By writing this 4 part mini-series about pricing, I hope to help you avoid these mistakes.

Part 1. Internal I. How does revenue relate to the income you can spend?

Part 2. Internal II. What does your time cost? If you break down your year, how much can fit in it? Setting up the right portfolio of products.

Part 3. Outside-in pricing. What to gauge the price-level on? I'll talk about the marketplace, the value of your product and perception of price.

Part 4. Should you work for free? You'll get approached with this offer, might as well know how to respond.

Few notes beforehand:

- This is the Dutch situation, based on euro and Dutch taxes.

- I want to go in depth, but also not read like a tax manual. Therefore, I've included some technical details in separate paragraphs between []-brackets. You can skip over these if you want.

- There are of course many types of businesses with vastly different cost structures. Not everything I talk about might directly apply. I'm using a material-light freelancer (zzp-er) for most examples. This might not be exactly you, but you can make your adjustments.

- Most importantly, more than the exact numbers, my aim is to get across this way of thinking.

- Ionica Smeets did a great piece on the subject. In it, she explains her rates by comparing them to the costs for the employer of a comparable employee. But because the tax structure is different for employees and freelancers, I thought it was helpful to write this.

Pricing 1: How much do you need to charge?

Obviously, a lot of the factors determine the price you can charge. It's a dance between you, the client and the marketplace. It gets complex quite quickly. So I want to start with the basics. You internal budgeting.

Before offering a price, you should know what the effect of doing the project or producing the product (i.e. time spent) for that price (revenue) is on your bottom line (profit). Because if your business is you, your time is what you have to create revenue.

In this first part, I'll explain how your revenue links to income. And I'll link that to pricing.

Fair warning. It's basic and slightly technical. We have to talk about taxes, ugh! But don't worry! It's only simple math. And getting the facts straight will serve as a foundation for more strategic decisions.

From desired net income to desired profit

To determine what prices you need to set, I'll work backward from your net income.

This starts with you setting an income goal for yourself. You know, how much do you want to be able to spend per month?

Now, it doesn't have to be yours or even realistic (yet). But, you do need to have one for reading this piece. Pick one now. Go back and adjust afterwards. Got one? Great!

Important things first! Not all profit of your business is yours to spend. The tax-man comes first. You know, your civic duty to pay your share to society.

So we need to remember the tax. Income tax (inkomstenbelasting), that is.

I'll ignore VAT (revenue tax or BTW) because you get some in, you spend some and you'll pay the difference. So VAT should have no part to play in budgeting.

[There are a few exceptions. For example, when you run a business where you don't have to add VAT to your invoices. Or when you have a small business and you end up having to pay less than €1.800 in VAT per year (Kleine Ondernemersregeling (KOR))]

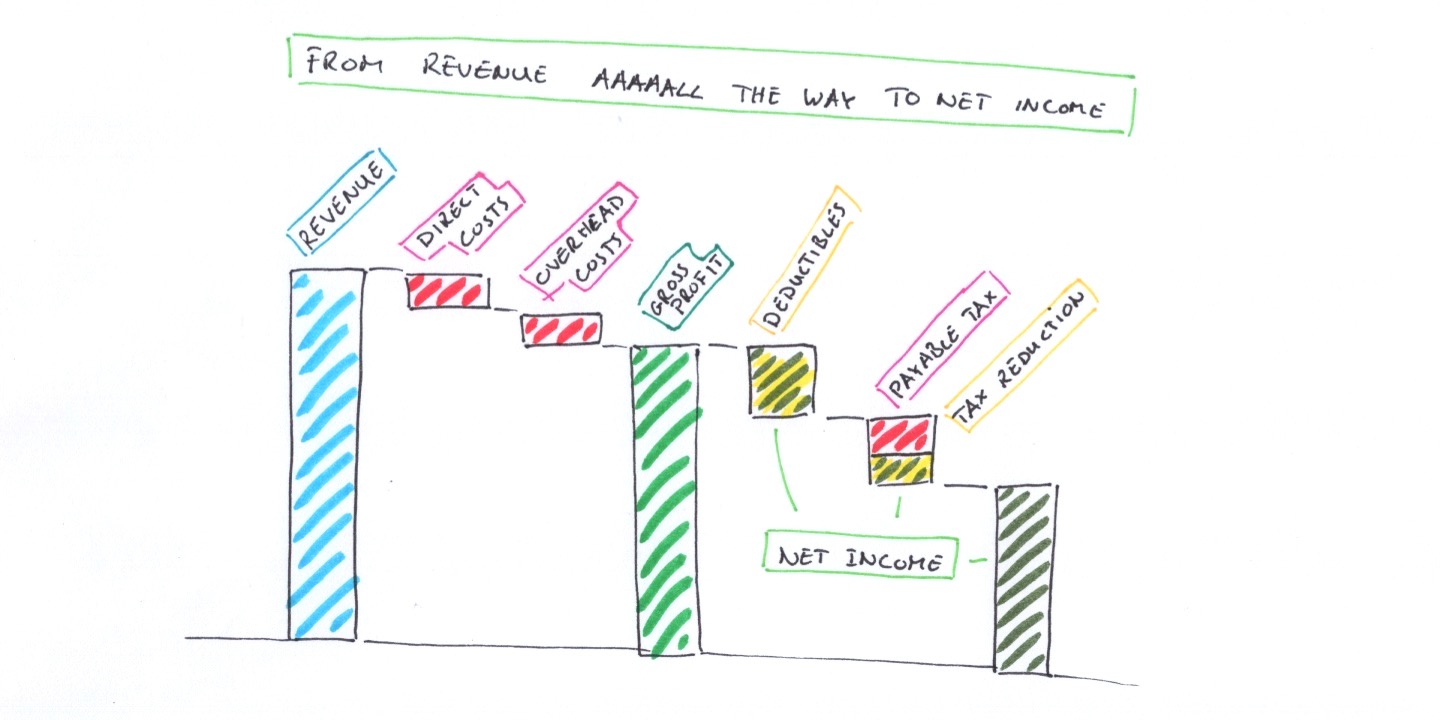

This is the difference between gross profit (Winst uit Onderneming) and net income. Especially when you start making enough of it, forgetting taxes can lead to some unpleasant payments.

[Technically, you can also keep money in your business and not pay out all your profit (privé-onttrekking). I'll assume you won't.]

So, let's calculate your needed profit based on your desired net income.

A few things to know. There are a few deductibles in Dutch taxes:

- Entrepreneur deductible (Zelfstandigenafstrek), €7.280 for 2017,

- Starting business deductible (Startersaftrek), €2.123 for 2017,

- Small business deductible (MKB-winstvrijstelling), 14% of your remaining profit.

[All three have certain requirements (check here). You have to be a full-time entrepreneur. Roughly, the requirements come down to working more than 1.225 hours per year and having multiple clients. You can only apply the Starting business deductible 3 times in your first 5 years of doing business. I'm assuming you qualify for all three deductibles.]

For 2017, these deductibles in a total of €9.403 + 14% of your remaining profits.

Meaning, to calculate your gross income over which you pay taxes, you get to deduct €9.403 from your profit and 14% of the remaining profit. You get to keep these deductions. This gives you your gross income (which up to €9.403 profit remains zero). How much income tax (Inkomstenbelasting) and contribution to national social insurance (Premie volksverzekeringen) you need to pay is based on this number.

[The taxes work with tax brackets (belastingschijven). Filled up one by one, the higher brackets having the higher tax percentages. Details here.]

But, also for these, there are tax reductions (Algemene heffingskorting en Arbeidskorting). These function as a buffer and reduce the amount of tax you need to pay. The amount of the buffer depends on your gross income.

Taking all these deductibles, taxes and reductions into account, how much profit do you actually need to make to earn a certain net income?

The following table lists your needed company profit and the percentage of taxes you pay for 4 different desired monthly net incomes.

| Monthly net income | Needed profit | Tax percentage |

|---|---|---|

| €1.500 | €18.500 | 2,7% |

| €2.000 | €24.800 | 3,2% |

| €2.500 | €33.200 | 9,6% |

| €3.000 | €44.600 | 19,3% |

Note:

- The first €26.000 of profit (roughly) is more or less tax-free. This is due to the deductibles and tax reductions.

- There is a great website Berekenhet that allows you to calculate more figures like these.

From profit to revenue

You may have noticed that, so far, I've not included any costs you make in running your business. No direct costs that you make in order to produce your product (like raw material, hired people, renting a space etc).

In the examples I show, I'll assume that these are zero because they vary too much per business. Of course, you might have costs for certain products. If so, add these to the revenue your aiming for these products and thus in the price you set.

On top of these direct costs, you have your overhead costs. These include things like an office or workshop, your gear/laptop/phone, software subscriptions, your website, trainings you go to in order to improve yourself, transportation, an accountant etc.

The totals for these can, of course, vary enormously between businesses. For this piece, I'm assuming about €500 per month. Or €6.000 extra costs per year.

Budgeting for these costs also allows you to become more professional and more efficient. Getting an office, while not completely essential because I can work from anywhere, allowed me to get more professional about my work. Or not worry about your taxes anymore by hiring an accountant so you can focus your time.

Ok, the last type of costs to consider. Something we freelancers are notoriously bad at: Building up a pension and putting money aside for rainy days. Of course, this is not for me to decide for you, but let's add another 20% on top on that needed profit

[Note: This 20% might be off. Add a comment if you have information on how much it should be.]

So, with all these costs to take into account, our needed profits become needed revenues.

| Monthly net income | Needed profit | Needed revenue |

|---|---|---|

| €1.500 | €18.500 | €28.200 |

| €2.000 | €24.800 | €35.760 |

| €2.500 | €33.200 | €45.840 |

| €3.000 | €44.600 | €59.520 |

I hope this helps give clarity on how much revenue will result in what you can spend privately.

What's the income you're designing your business for? Pick a number for now.

How to set a realistic revenue goal? Make two estimates. (1) A minimum. An amount you'll make no matter what. (2) A success. An amount you'll make if everything goes right. Take 70% of number 1, and add 30% of number 2. Voila, your realistic revenue goal.

Now, it can be that everything seems too high. You might just be getting started. The rules of this part of the game don't change, however. If you expect to make less revenue, you'll need to make choices which costs to save money on or how to do with less income.

For this series, I'll pick in the middle of the examples I gave and work with €40.000 yearly revenue.

From revenue to activity.

So earning €40.000 a year. Let's break it down to get a better understanding how much that is. You can make €40k, by:

- billing 400 hours over a year at €100 an hour. Or 800 at €50 an hour.

- doing 40 workshops at €1.000 a piece. Or 80 at €500.

- selling 20 products of €2.000 each. Or 2.000 in sales of €20 each.

- creating 80 videos on Youtube with 500k views (€1 per 1.000 views through Adsense)

Of course, you can also have a mixed portfolio of activities:

- 10 workshops with 50 participants paying €40 each,

- 10 workshops for clients of €1.000 a piece,

- 100 hours of consulting at a €100 hourly rate.

I hope this helps to create an overview to determine what you need to be asking for to be fair towards yourself now and in the future.

The last questions I want to leave you with are:

- What is your realistic revenue goal you're budgeting on?

- Do the prices for the coming and past projects result in that yearly revenue?

- If you cut in your needed revenue, what are you giving up? And have you budgeted for disappointments?

- If you succeed in making your goals, what will you invest the extra money or time in? What are the next steps for your business?

In part 2 (Internal II), I'll break down your available hours in a year to get to the internal costs of spending time on a project/product.

Subscribe to me on Medium if you want to read the rest of the series. And if you liked it, hitting that heart button or sharing it helps others find this piece too.